November 8, 2021

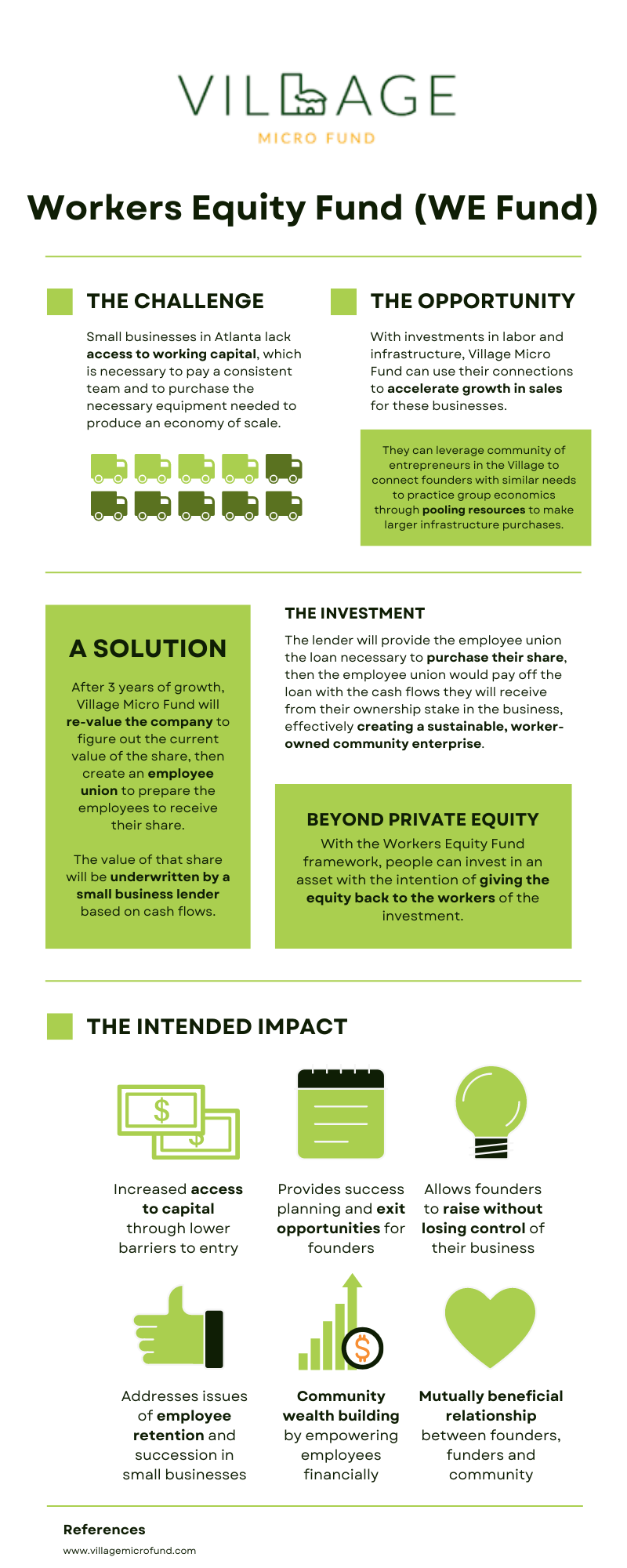

Access to Capital for Entrepreneurs (ACE) is a Georgia 501(c)(3) nonprofit and community development financial institution (CDFI) that provides capital, coaching, & connections to help borrowers create & grow businesses.

Small Business Assistance Corporation (SBAC) is a community development financial institution (CDFI) that invests in new, existing and expanding businesses that have created or retained jobs, providing a positive economic impact within their community.

Georgia Power Foundation is a Georgia 501(c)(3) private foundation, and the charitable arm of Georgia Power Company. The foundation focuses on improving education equity, environment and empowering communities across Georgia.

Partnership History: The Georgia Small Business Capital Fund was capitalized during the height of the pandemic in 2020 when three (3) CDFIs from across Georgia – Access to Capital for Entrepreneurs (ACE), Small Business Assistance Corporation (SBAC) and Albany Community Together! (ACT!) – had a conversation with Georgia Power Foundation about ways that they could collectively make an impact at scale across the state. Between the three CDFI partners, they touch or represent all 152 counties in Georgia.

Georgia Power Foundation made a $500,000 state-wide investment into the Georgia Small Business Capital Fund to enable $1 million in lending and technical support to 75 small businesses, and operational support to the three (3) aforementioned CDFIs, catalyzing collective impact for over 1,000 small businesses in Georgia. Sixty eight (68) percent of these investments supported minority and women-owned small businesses, and the entire investment supported underserved communities and populations.

Q&A: The following is a Q&A with Sydney Hulebak, Director of the Georgia Social Impact Collaborative (GSIC); Rita Breen, Executive Director of the Georgia Power Foundation (GPF); Martina Edwards, Chief of Strategic Partnerships for Access to Capital for Entrepreneurs (ACE) and Victoria Saxton, Chief Financial Officer for Small Business Assistance Corporation (SBAC).

Sydney (GSIC): Rita, can you share a little bit about Georgia Power Foundation’s history in funding CDFIs and CDFI capacity across Georgia?

Rita (GPF): Georgia Power Foundation supported ACE for a number of years, and they really helped us see how effective and impactful a CDFI can be in a community. Our funding footprint is statewide, and knowing that when you move outside of Metro Atlanta, funding and funders become more scarce, we saw this as an opportunity to further explore the CDFI ecosystem across Georgia.

Our foundation focuses on education, environment and empowering communities – and part of empowering communities is empowering small businesses. When diverse small businesses thrive, they create wealth for the owner(s) and also create jobs for others in the community.

Sydney (GSIC): Why did Georgia Power Foundation decide to support a coalition like the Georgia Small Business Capital Fund as opposed to funding each CDFI independently?

Rita (GPF): There were two main reasons: 1) geography – we wanted to bolster diverse, small businesses across the entire state and 2) partnership – we encourage nonprofits to partner, share dollars, resources and best practices to amplify impact.

The Georgia Power Foundation and Georgia Power’s Community and Economic Development conducted a joint virtual listening tour with local and national funds and non-profits. When we learned about the Georgia Small Business Capital Fund, we were excited because these three CDFIs were already working together with a formed fund that just hadn’t been utilized yet. Funding a coalition of support across the state presented a chance to foster greater impact and matched our mission to work across urban and rural Georgia.

Sydney (GSIC): Many foundations begin their impact investing journeys by considering program-related investments (PRIs) into local CDFIs. Rita, can you share why Georgia Power Foundation favored capacity-building grants and how those grant dollars helped the CDFIs leverage additional capital?

Rita (GPF): During COVID we learned that CDFIs had a great opportunity to access lending capital through PPP and other federal dollars. We also discovered that CDFIs did not have the funding required for the human capital needed to administer a larger loan portfolio as well as to provide more technical services to small businesses in crisis due to the pandemic.

We listened to those needs and encouraged fund partners to leverage the unrestricted dollars we provided in a way that allowed each CDFI to best deploy dollars into the community.

Additionally, due to the challenges COVID presented for small businesses, the CDFIs shared with us that the entrepreneurs they worked with needed more technical assistance, training and consulting, which also pointed to the need for grant dollars to support capacity and optimize the loan portfolios.

Ultimately, this arrangement made sense for the outcomes that were best for the CDFIs and Georgia’s communities.

Sydney (GSIC): Martina and Victoria, can you both speak to the value of receiving unrestricted grant dollars in partnership with those investment dollars, and how this example of Georgia Power Foundation’s support of the Georgia Small Business Capital Fund can serve as a case study for other impact-oriented funders?

Martina (ACE): The funding from Georgia Power Foundation’s grant was instrumental in bringing these three CDFI partners together, allowing each of us to reach our respective markets in a way we felt would best suit businesses that needed help on the ground.

For ACE, that is Metro Atlanta and rural north Georgia. While the pandemic has cut across all of these counties, resources in communities are not created equal. The flexible capital provided by Georgia Power Foundation allowed each of us to utilize those dollars in different ways based on client needs. ACE, for instance, used our $165,000 to create a cash reserve, allowing us to draw down additional capital from the Small Business Association (SBA), which requires a 15% reserve as a risk mitigant.

This grant also helped build up our capacity. For example, in 2019, we made 91 loans totaling $13.1 million, which was a breakout year for ACE. Then, the pandemic hit, and we saw 400% more loan clients in 2020 representing just over $25 million in lending.

Despite all this growth, we had the same size team. This pool of dollars allowed us to draw down more lending dollars and use other grant capital for capacity building on both the human capital and infrastructure side. Between 2020 and 2021, ACE hired fourteen (14) additional staff members so that we could continue to not just serve as a lender, but also provide the wraparound services – coaching and connections – that differentiate CDFIs from banks. We were also able to hire four (4) financial advisors on our business advisory team to work with every single loan client, providing guidance on how to pivot their business models to ensure they emerged from the pandemic more resilient than before.

Victoria (SBAC): SBAC found ourselves in a similar situation to ACE. We were used to doing 60 loans a year, but once the pandemic hit, we saw a 100+ increase. In order for SBAC to continue our model of providing advisory services in addition to lending for all borrowers – regardless of whether it was a $10,000 loan or a $10 million loan – we needed unrestricted capital.

CDFIs tend to get a lot of federal dollars; however, these tend to come with a specific purpose and required output attached. With unrestricted capital, we have the ability to leverage that capital where we see the greatest need for both lending and internal operations.

For SBAC, that meant bringing on new staff. This is often a challenge for CDFIs because we tend to compete with banks for talent. While the services we offer and time spent with clients is typically the same for both CDFIs and traditional lenders, nonprofit CDFIs often work more with small-dollar clients, making it so that we have a smaller budget to attract talent.

And the right talent is important for our portfolio management given the business advisory services we offer that help the small businesses we support thrive. This includes a variety of scholarships and training programs that you often don’t find when working with a banking partner.

Martina (ACE): Leveraging this flexible capital looked so different for each party involved. As mentioned, ACE used it for a cash reserve and SBAC was able to use a portion for operations. However, our third CDFI partner, Albany Community Together! (ACT!), utilized the grant dollars for innovative flexible capital, focusing on small businesses in hard hit sectors like the medical industry.

Despite the attention on healthcare, many medical businesses, particularly those that focused on elective surgeries, had to close or had a customer base that was too fearful to come in for services during COVID. ACT! created a pool of dollars for debt payment relief, allowing those businesses the opportunity to move forward unanchored by debt obligations and focus instead on how to respond once mandates were lifted. This included paying for some of the protective mechanisms that allowed customers to comfortably re-enter their doors.

In addition, internally, CDFI margins were squeezed during the early pandemic. CDFI earnings traditionally come from their loan products. However, during COVID, many offered PPP, providing 1% loans to clients, even though our cost of capital was not less than 1%. Therefore, CDFIs had to determine how to offer PPP and still have a sustainable business model.

Funders like Georgia Power Foundation stood in this gap with us as we leveraged other options like credit enhancements and interest rate buydowns. Unrestricted grants like this served as a subsidy in this low interest rate environment, allowing CDFIs to continue to offer competitively low rates to clients while managing cost of capital, which helped with the squeeze of earnings and net interest margins.

Sydney (GSIC): Martina and Victoria, can either of you share more about the typical client that a CDFI serves in Georgia, and why their needs were compounded during COVID?

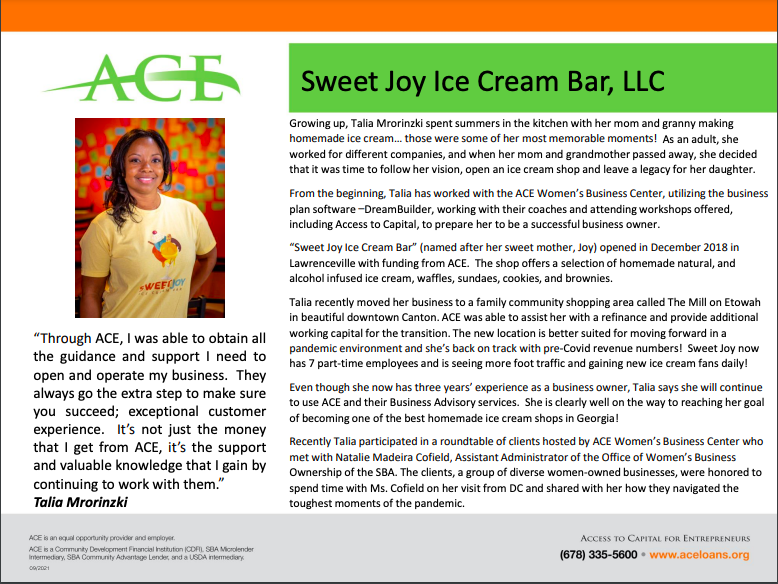

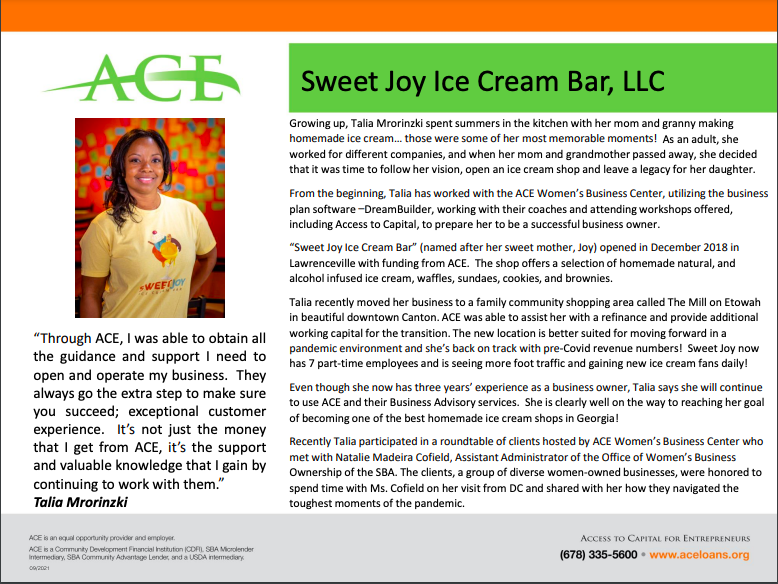

Martina (ACE): As a CDFI, we can lend to anyone, but each organization in this collaborative focuses on diverse, low to moderate income, women-owned businesses. And we know that these communities, especially in rural areas, have been more challenged when you layer on the health crisis of the pandemic. This is due to the fact that these business owners are already operating on smaller, thinner margins and have more limited access to credit given the institutionalized policies that limit the ability of BIPOC (Black and indigenous people of color) individuals to gain access to capital or create wealth in the first place.

Sweet Joy Ice Cream Bar, LLC based in Lawrenceville, Georgia is an example of an ACE client.

Sydney (GSIC): In many ways, CDFIs are the original impact investor. And, right now, they are undergoing a moment of national attention and increased funding. Given that the work of CDFIs will continue to be important beyond COVID recovery, what does it look like for you all to have the support you need in the long-run and how can impact investors be a part of the conversation?

Victoria (SBAC): If a small business owner can’t get to a bank, CDFIs are still the only option for capital access aside from hard money lenders that require outrageous interest rates. So, it is great that CDFIs are getting more attention and that more potential partners better understand what we do and what we can provide.

SBAC is now being approached by colleges and universities, and even new development authorities are reaching out to collaborate. These entities don’t have the ability to do lending and compliance and are looking to CDFIs to perform these operations. However, for CDFIs like ours to operate at the desired output required by these partners while still building intentional communities across the state, we need impact-oriented investors.

Impact investors can help bring lending capital to the table, as well as provide operating grants to grow both staffing and technology in a way that allows us to continue to increase capacity and deliver good customer service to clients. SBAC considers itself a high tech and a high touch organization. If you contact us, we want to ensure that you are connected with a live person that can determine how best to meet your needs.

Impact investment and accompanying unrestricted grant capital can serve as a bridge to help CDFIs meet this continuous need across Georgia moving forward.

Martina (ACE): Agreed. Impact investing is helping to increase the innovative and proven strategies of CDFIs. ACE is in its 21st year and we have a track record of great work that has only continued to accelerate in this time period. And we are like a small business ourselves. As we grow and scale, we encounter new pain points. Flexible capital provides us with the capacity to invest back in our organization while providing visibility to the small business owners on the ground doing their work. With this in mind, a pairing of both unrestricted grant capital for operations and PRI investments for greater lending creates a successful recipe for CDFIs.

It is helpful for impact investors to understand that CDFIs can be a solution for impact investing while also providing reliable returns from a PRI perspective, which is a great way to continue to do good.

CDFIs create collective prosperity through the fact that underserved business owners are able to get the support they need to grow their assets, grow their businesses and increase their overall revenue, which in turn, allows them to hire more people. This job creation is an economic opportunity for Georgia, providing more families with financial stability and leading to healthier and thriving communities.

Sydney (GSIC): Rita, do you have any advice for foundations that have never worked with intermediaries like CDFIs before? How should they consider getting started?

Rita (GPF): The trend in philanthropy has been to report on impact/ROI, which best lends itself to funding programs. However, as funders during an unprecedented time, we need to listen, collaborate and be supportive of nonprofit partners’ needs. If we help our CDFI partners accomplish their objectives of serving small, diverse businesses, we also achieve our goals.

Sydney (GSIC): Finally, Rita, has Georgia Power Foundation’s investment in this collaborative inspired you to look at more investments in CDFIs? What does this mean for your strategy moving forward?

Rita (GPF): Strategically, since this investment in mid-2020, Georgia Power, along with the Georgia Power Foundation, has committed to invest $87 million throughout 2021-25 to continue advancing racial equity and social justice efforts in Georgia. This funding will support initiatives focused on education equity, criminal justice equity, economic empowerment, and energy justice.

This coalition of three CDFIs – ACE, SBAC and ACT! – exceeded our expectations, which was very encouraging for us as a funder. It was exciting to see what they did to support over one thousand diverse small businesses across the state. That type of result makes us want to do more, and we have. Georgia Power Foundation has funded additional CDFIs, including some outside of this coalition. We have seen how powerful these investments can be for economic empowerment and look forward to continuing our support of diverse small businesses.

Read 4 Unity has successfully leveraged existing distribution channels to provide diverse children’s books to more communities in Georgia and beyond. It has forged partnerships with The Little Free Library, Kennesaw State University, and Yenny’s alma mater Georgia Southern University to increase Read 4 Unity’s footprint without straining the organization. The Georgia Southern University office of Diversity and Inclusion and the Georgia Southern University Collegiate 100 partnered with Read 4 Unity to create and manage Read 4 Unity book nooks in and around Statesboro and Savannah. The Georgetown Law School student group in Washington D.C. has also sponsored a Read 4 Unity book fair.

Read 4 Unity has successfully leveraged existing distribution channels to provide diverse children’s books to more communities in Georgia and beyond. It has forged partnerships with The Little Free Library, Kennesaw State University, and Yenny’s alma mater Georgia Southern University to increase Read 4 Unity’s footprint without straining the organization. The Georgia Southern University office of Diversity and Inclusion and the Georgia Southern University Collegiate 100 partnered with Read 4 Unity to create and manage Read 4 Unity book nooks in and around Statesboro and Savannah. The Georgetown Law School student group in Washington D.C. has also sponsored a Read 4 Unity book fair.

Self-described as “Atlanta’s home for good trouble,” the

Self-described as “Atlanta’s home for good trouble,” the  Ashani O’Mard served as the Executive Director for the

Ashani O’Mard served as the Executive Director for the

Brian (GBS): The ‘Business and Society Institute’ is a new name and elevated commitment. We got a gift from the Goizueta Foundation that allowed us to move from a center to an institute and build on the work we’ve been doing for ten years. The

Brian (GBS): The ‘Business and Society Institute’ is a new name and elevated commitment. We got a gift from the Goizueta Foundation that allowed us to move from a center to an institute and build on the work we’ve been doing for ten years. The

Atlanta based entrepreneur Njeri Warfield is hoping to change the landscape for women and diverse-led companies while providing more opportunities in the commercial real estate industry. He

Atlanta based entrepreneur Njeri Warfield is hoping to change the landscape for women and diverse-led companies while providing more opportunities in the commercial real estate industry. He