June 27, 2019

By: Scott Sadler, Founder and President, Boardwalk Capital Management

Today’s companies echo the refrain that “sustainable business is good business” (or something like that.) But eight or nine years ago, that wasn’t necessarily the case.

Most businesses at that time had yet to openly embrace sustainability, and the investing public surely didn’t uniformly believe that such activities were a good use of corporate funds. Even today, investors still don’t all buy into the story. But, as they say, “that’s what makes a market.” (You’ll never get everyone to agree on anything.)

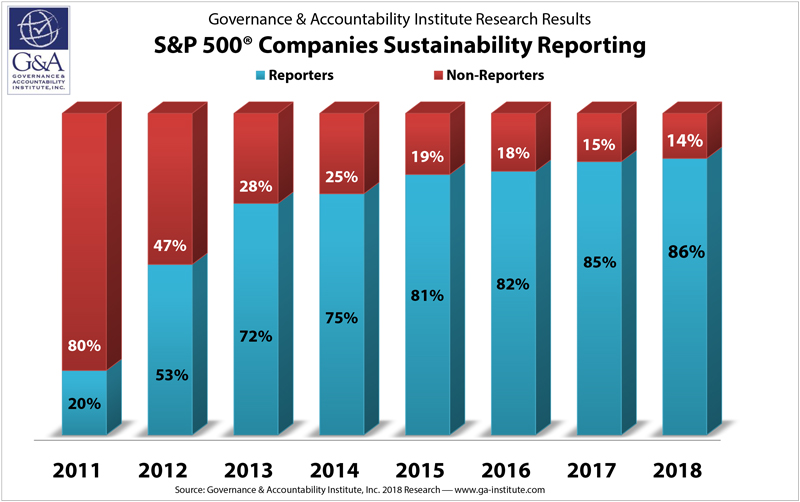

As an indicator of how far sustainability was from the mainstream in 2010, only 20% of the S&P500 reported on sustainability factors. It was still a confusing topic for many, and the term was still rather ill-defined in the public eye.

As the owner of a new company focused on sustainable investing, I knew we had a challenge. We wanted to tell the story that sustainability is about running a better company, and that including these factors in an investment process was logical and (importantly) didn’t undermine financial returns. But as a startup, our credibility was a little on the light side.

So, we teamed up with the Green Chamber of the South, where I was a board member, to create a new kind of sustainability conference. We enlisted the help of Atlanta’s (and the region’s) companies and created a conference where the investing and business public could hear this truth about corporate sustainability directly from the decision makers. Where my company lacked credibility, the region’s corporate giants had it in spades.

Of course, we weren’t sure what we’d hear from those companies. Would they even want to participate? And would they tell the same story that we were telling? It turns out that we need not have worried.

We called that conference “Sustainability Interactive” (SI) and joked that it was like speed dating with a room full of CSOs (Chief Sustainability Officers.) Indeed, attendees moved from table to table to hear sustainability officers tell their stories. Incorporating a cocktail reception in the mix helped drive free flowing conversations and networking.

In retrospect, the conference was well timed. To quote one attendee from the solar industry, it signaled “a sea change” in business attitudes in the Southeast. Companies told a story about Return-on-Investment (ROI). Yes, their sustainability programs were an investment – with a payback period and an expected return. This wasn’t about hugging trees. It was about reducing costs, building more resiliency and reducing risks. (And thank goodness that’s what we heard…)

On November 4, Sustainability Interactive will be back again, in its seventh edition. And the conversation around the event is completely different. Sustainability is a “given” among companies large and small. And while few companies published a sustainability report in 2010, 86% of the S&P500 does so today. Customers, shareholders and employees alike are engaged and are choosing to vote with their time and their dollars for companies whose principles and actions sync with their own.

From my perspective, companies have evolved greatly over this period, but perhaps not as much as their messaging has. With a more receptive audience among customers and investors, what was once rather hidden moved to the front. Yes, they are doing more. But they’re also saying more.

So, SI-7 will be about companies doing more, and yes, telling us about it. The conference will focus on business playing a role in addressing what ails our world. We’ll be using the UN Sustainable Development Goals as a template and learning how companies in the Southeast are addressing these needs. We’re looking forward to another lively evening. Visit www.greencs.org for more info.

###

Atlanta-based Boardwalk Capital Management is an independent Registered Investment Advisor specializing in Sustainable and Responsible Investing. Their principals have decades of combined financial experience, providing counsel to individuals and institutions all over the country. They offer both proprietary investment solutions, and premier third-party managed strategies, in order to meet the unique needs of each client. Certain principles transcend investment styles. Boardwalk Capital Management firmly believes in the value of asset diversification, tax efficient management and full transparency. Learn more at https://www.boardwalkcm.com/.

The Green Chamber of the South aims to bring together businesses and organizations across the Southeast to promote the growth, innovation and success of sustainability. Discover more at https://greencs.org/.

The Georgia Social Impact Collaborative (GSIC) provides resources to connect, educate and inspire stakeholders for the purpose of accelerating the development of Georgia’s impact investing ecosystem. Recently, GSIC announced the launch of the Georgia Social Impact Map (the “Map”), an interactive platform designed to connect and educate stakeholders interested in accelerating impact investing for social outcomes. Intended as a resource for communities around the state, the Map connects new forms of capital to sustaining and scaling solutions to social challenges. GSIC also provides workshops and programming for training specific groups of stakeholders on ways to leverage impact investing to achieve their impact goals.