Revolving Fund Drives Social Impact for Atlanta Communities

By: Stacy Funderburke, Assistant Regional Counsel & Conservation Acquisition Associate, The Conservation Fund

February 26, 2020

In January, Atlanta Mayor Keisha Lance-Bottoms and Department of Parks & Recreation announced a new 12-acre park in one of the most under-parked areas of the city. This large greenspace will create a new park and recreational amenities for neighborhood residents, while protecting a tributary of the Utoy Creek Watershed and conserving almost 10 acres of Atlanta’s tree canopy. A week later the Beltline and Parks Department announced the acquisition of a property that will allow critical expansion of Boulevard Crossing Park on the Beltline, setting the stage for an expansive new vision and design for one of the largest parks along the future Southside Trail.

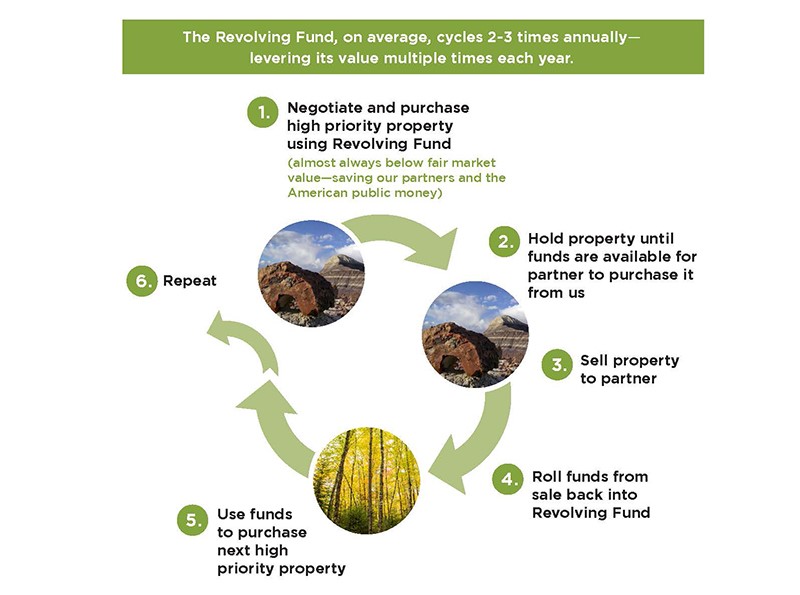

Believe it or not, these important park acquisitions were made possible by one of the longest standing impact investments in Atlanta – the Metropolitan Atlanta Parks and Greenspace Acquisition Revolving Fund. The Metro Atlanta Revolving Fund was originally created by a $2 million philanthropic gift from the Arthur M. Blank Family Foundation to The Conservation Fund, a national non-profit dedicated to land and water conservation. It operates with a unique model for sustainably financing conservation outcomes – a revolving fund fueled by grants committed to land and water conservation.

In a world where public funding for parks, trails, greenspace often lags the immediate capital needed to acquire priority park lands when available, particularly when real estate is booming, the quickest, nimblest partners with ready capital are the ones who can make these acquisitions happen. The Conservation Fund has a long track record of bridging that capital need, stepping out to acquire those highest priority conservation lands for local, state and federal partners, and holding those lands until public funding comes available.

We have worked with partners for over 15 years, continually revolving that original $2 million investment to turn underused land into parks, greenspace and trail corridors in Atlanta. While the total fair market value of the acquired land was approximately $34 million, we were able to acquire it at a total cost of approximately $30 million, passing along significant savings to our public partners. Through the revolving fund we have been able to add 506 acres of greenspace in 45 parks across the Atlanta, many of which would not have happened without The Conservation Fund’s real estate expertise and ready access to this revolving fund capital. Those acquisitions often leveraged other philanthropic funding for capital improvements or buildout of parks and trails.

The impacts of this revolving fund model are not limited to the City of Atlanta. At the state level an $8 million revolving fund we manage has leveraged significant state, federal and philanthropic funding and supported approximately $285 million in conservation acquisitions with a total fair market value over $360 million. Nationally, we have acquired over 8.3 million acres with a fair market value of over $7 billion at a total acquisition cost of approximately $5.2 billion. And these revolving funds can be scaled in a variety of ways. Most recently, we announced our first ever public issuance of a green bond, leveraging impact capital for an additional $150 million in revolving funds for our Working Forest Fund program, which aims to protect 5 million acres of the most critical forest land under threat across the country over the next 15 years.

There are many different definitions of impact investing. But it’s important for us to embrace the variety of investment models that allow us to achieve outsized impacts for our communities, understanding there are myriad ways to make investments go farther for a particular impact. Our Atlanta revolving fund is just one example of how non-profit partners can utilize revolving funds to marry philanthropic investments with public sector priorities to scale outcomes and impact for communities – adding parks, trails and greenspace that improve quality of life for area residents and protect the amazing natural areas we have access to in our city. If you overlooked this model as part of the broader impact investing universe, your next outing in your neighborhood park or stroll along the Atlanta Beltline should help jog your memory!

The Conservation Fund works with public, private and nonprofit partners, to protect America’s legacy of land and water resources through land acquisition, sustainable community and economic development, and leadership training, emphasizing the integration of economic and environmental goals. Top-ranked for efficiency and effectiveness, The Conservation Fund has worked in all 50 states to protect over 8 million acres of land since 1985.

The Conservation Fund

The Conservation Fund