On January 28, 2025, GSIC hosted an educational webinar, “Local Impact Investing, the Next Frontier of Community Foundation Leadership,” to help Georgia’s community foundations to understand how peers across the country are embracing local impact investing as a powerful new tool to drive impact. In this conversation, GSIC’s Executive Director Sydney England provided attendees with foundational lessons about this practice. Those highlights included:

Clarifying Impact Investing Definitions

Impact investing is a broad and growing field, with over $1.5 trillion in assets under management globally (Global Impact Investing Network, 2024). Impact investing is an umbrella term that encompasses different approaches and strategies.

- Divesting is the practice of selling shares or bonds in a company due to a fundamental disagreement with its business practices or when the company’s outputs are antithetical to the investor’s mission or values. This could look like an environmental nonprofit divesting from fossil fuel companies or a health-focused foundation divesting from tobacco and alcohol stocks. Once divested, impact investors can work with investment managers to ensure that those companies are excluded from future investment selections and allocations.

- ESG Investing focuses on integrating Environmental, Social, and Governance criteria into investment decisions. ESG investing evaluates how well companies are managing risks and opportunities related to these criteria, which can affect long-term financial performance.

- Thematic Impact Investing goes a step beyond ESG by actively seeking investments in companies or projects that have a direct, positive impact on specific social or environmental issues. It aligns with the investor’s intent to generate measurable, positive outcomes alongside financial returns. Thematic impact investing targets specific issues or causes, such as renewable energy, affordable housing, education, health care, or gender equality. Investments are chosen for their potential to make a direct impact in the chosen theme, meaning that the business model or operations inherently address these social or environmental challenges.

- The webinar focused on the growth of local impact investing by community foundations. Local impact investing stands out as a practice of investing in companies, projects, businesses, or organizations to generate both financial returns and measurable community impact. Unlike traditional grantmaking, these investments have the potential to be recycled back into the community, creating sustainable cycles of growth and opportunity.

Sizing the Field

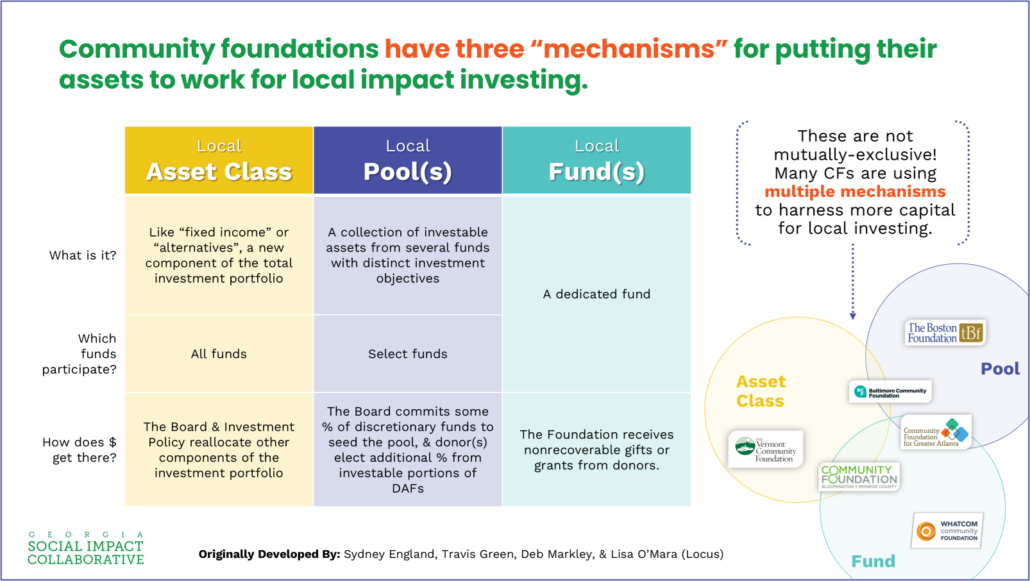

Community foundations have been practicing local impact investing for decades, stretching back to the 1970s, but in recent years, we’ve seen more rapid adoption by community foundations across the country. Today, the United States is home to ~900 community foundations, but while there isn’t a single, comprehensive database, there are ongoing efforts by the Community Investment Project, FEG Investment Advisors, and others to accurately account for the number of community foundation local investors. Based on these surveying efforts, we can comfortably say that at least 1 in 10 community foundations have established local impact investing commitments.

Acknowledgments

I want to thank Marsha Pope, President of the Topeka Community Foundation, and Katrina Rolle, President of the Community Foundation of North Florida, for bringing their insights to Georgia. This webinar would not have been possible without their contributions. Sydney Hulebak, from the Community Foundation for Greater Atlanta (CFGA), provided an important call-to-action for community foundation peers across the state. CFGA’s leadership in the local investing space cannot be overstated, and their staff continue to be incredible resources for peer community foundations in Georgia. Finally, I would be remiss if I didn’t take a moment to acknowledge the work of my friends and former colleagues Deb Markley, Travis Green, and Lisa O’Mara. The basis of this webinar as well as my understanding of community foundations and local impact investing was formed by the work that we did together at Locus. This is the product of our collective thinking and efforts, and I share attribution with you all.

Upcoming Programs

There are several upcoming education and skill building opportunities for community and private foundations looking to get started with impact investing (even beyond local investing).

- On February 27, Philanthropy Southeast is hosting an impact investing session as a part of their “Community Foundation Skills-Building for Senior Leaders” series. Register Here

- On March 27, GSIC will host a 90-minute virtual workshop with Rosalie Sheehy Cates on the topic of “Good Governance and Impact Investing.” Register Here

- On May 5-7, Mission Investors Exchange is hosting the 2025 Mission Investing Institute in Atlanta. This regional gathering provides philanthropy professionals with best practices to develop the strategy and capacity for an effective mission-aligned investing program. GSIC partners can register for the 2025 Institute at a discount! Use the code INST2025GSIC to receive a $500 discount. Register Here

Key Movements in the History of Community Philanthropy

It might be easy to write-off the growth of local impact investing by community foundations as the “new shining object” – philanthropy’s current flavor of the month. However, this is not a passing fad, and those steeped in the history of community philanthropy can see local investing for what it is – an organic outgrowth of important movements and inflection points that have occurred in the field.

Lessons from the Field

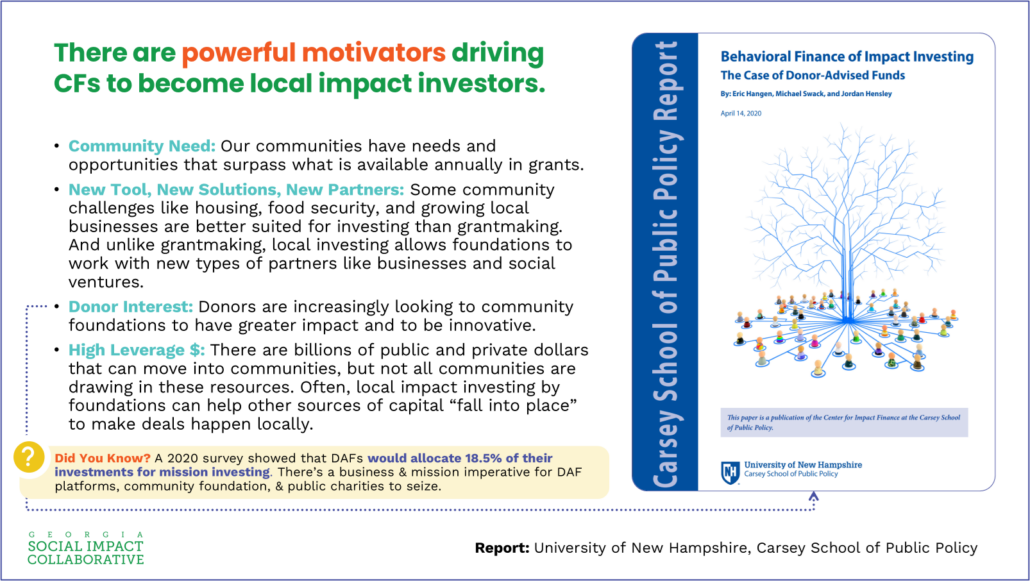

This historical backdrop has influenced many community foundations to adopt the tool of local impact investing, but there are other, more current factors accelerating this practice.

- Addressing Growing Community Need: Economic inequality is growing. Communities across the country are grappling with housing & food insecurity, constrained economic & employment opportunities, limited childcare services, aging community infrastructure, increasing climate & disaster issues, and more. The cost of addressing these social challenges far exceeds available grant funding. Looking beyond grants to the investment portfolio offers community foundations another pool of capital resources to address community need.

- Working with New Partners & Solutions: Tackling any of these community challenges may require different partners like CDFIs, housing developers, government agencies, and for-profit enterprises. Grantmaking is still a vital form of capital for communities, but the addition of local impact investments brings another flexible tool to use when partnering with these different stakeholders (even for-profits).

- Responding to Changing Donor Expectations: A 2020 national survey conducted by the University of New Hampshire’s Carsey School of Public Policy revealed that, if given the option, DAFs would allocate 18.5% of their investments for mission investing. This data suggests that it is both the next generation and current generation of donors expect to maximize the impact of their charitable giving.

- Leveraging Public & Private Capital: Important as it is, philanthropic capital will never supplant the need for additional public and private capital. There are billions of public and private dollars that can move into communities, but not all communities are drawing in these resources. Often, local impact investing by foundations helps other sources of capital “fall into place” and catalyzes more investment locally.

As community foundations continue to evolve, local impact investing presents an opportunity to deepen their role as community leaders. By aligning financial resources with mission-driven objectives, they can unlock new pathways to economic and social prosperity. In practice, community foundations face challenges in adopting local impact investing, including concerns about financial risk, regulatory compliance, and aligning investment strategies with mission-driven goals. However, leading practitioners emphasize that the long-term benefits – economic growth, community resilience, and expanded philanthropic influence – far outweigh the initial hurdles. Marsha Pope, President of the Topeka Community Foundation, and Katrina Rolle, President of the Community Foundation of North Florida, shared insights on overcoming these challenges. Marsha and Katrina underscored the importance of board education, strategic partnerships, and incremental implementation. They offered practical advice for Georgia’s community foundations.