Atlanta’s Entrepreneurial Ecosystem Roundtable

On February 5, 2025, TruFund Financial Services (TruFund), a leading community development financial institution (CDFI) held its Annual Ecosystem Breakfast – bringing together more than 30 key stakeholders from Atlanta’s entrepreneurial and small business ecosystem. A diverse mix of participants – representing traditional banks, CDFIs, quasi-government agencies, business support organizations, and private sector investors – contributed to a lively, generative discussion on the challenges and opportunities within the ecosystem. In the room alone, participants represented a diverse “asset base” to build around – each with bringing financial, intellectual, social, political, and culture capital to the table. What would it look like for Georgia to build a strong entrepreneurial ecosystem? Are there lessons to be learned from Kansans?

If you want to understand something as complex as a strong entrepreneurial ecosystem, it helps to look for common signs of success. In other words, what makes an ecosystem “high functioning?” These indicators give you a way to measure what’s working and where there might be gaps. They also make it easier to compare different places, spot trends, and focus efforts on what actually helps businesses and communities thrive.

Indicators of a High-Functioning Entrepreneurial Ecosystem

Due to the tireless combined efforts of the National Center for Economic Gardening, National Commission on Entrepreneurship, Kauffman Foundation’s Center for Entrepreneurial Leadership, Corporation for Enterprise Development (once CFED and today Prosperity Now), the Center for Rural Entrepreneurship, and the Federal Reserve Bank of Kansas City, practitioners today have the language to define high-functioning entrepreneurial ecosystems. These ecosystems are often characterized by seven key indicators.

Strong Networks & Collaboration

Active partnerships between startups, investors, universities, and government entities that enable knowledge-sharing and resource access.

Access to Capital

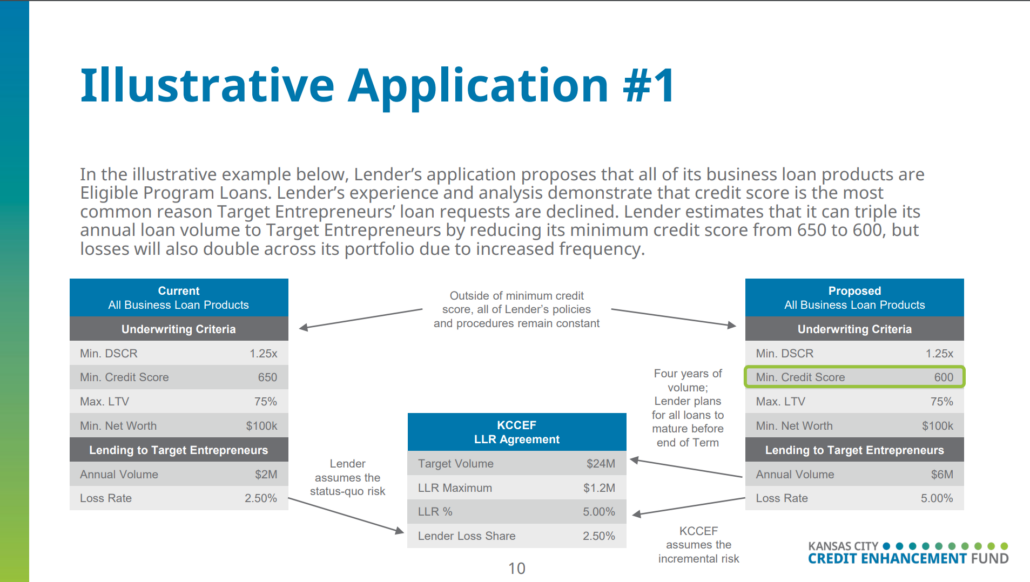

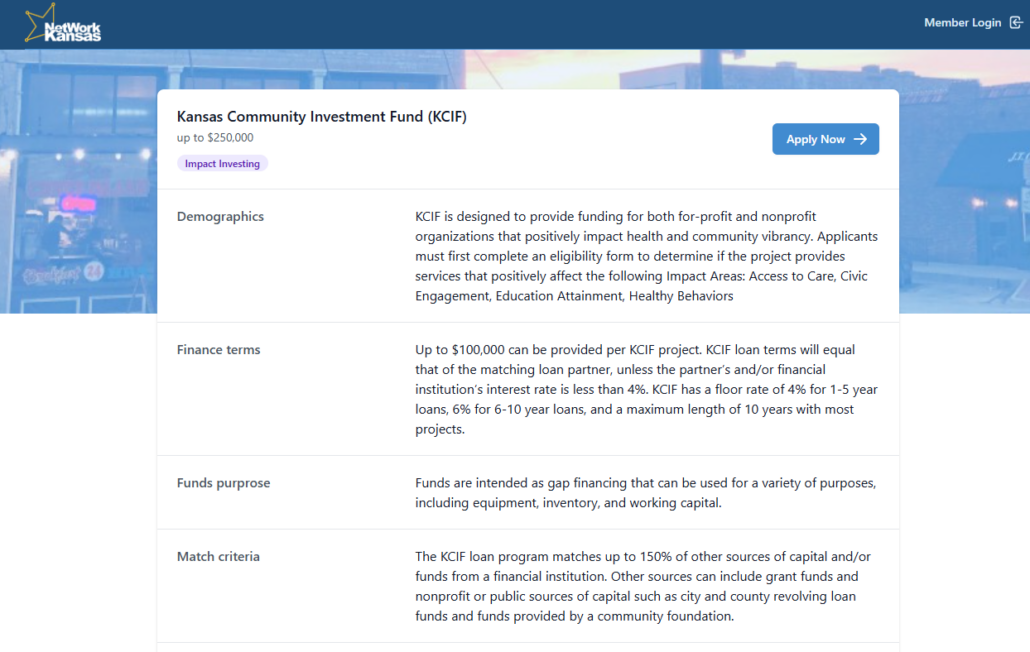

A robust pipeline of funding sources across all business stages, including grants, venture capital, and non-traditional financing mechanisms.

Inclusive & Diverse Participation

Equitable opportunities for underrepresented founders, ensuring all entrepreneurs have access to mentorship, capital, and support.

Talent & Workforce Development

Entrepreneurship education, skills training, and retraining initiatives that prepare individuals for new business ventures.

Policy & Infrastructure Support

Business-friendly regulations, broadband access, transportation networks, and affordable co-working spaces.

Industry Clusters & Market Demand

The presence of anchor institutions, key industry hubs, and demand-driven market opportunities.

Culture of Innovation & Risk-Taking

A community that celebrates entrepreneurship, embraces failure as a learning opportunity, and fosters continuous experimentation.

The “Sunflower State’s” Playbook for Entrepreneurial Ecosystem Development

The Kauffman Foundation’s Entrepreneurial Ecosystem Playbook 3.0 outlines six key pillars essential for building and sustaining thriving entrepreneurial ecosystems – Talent, Density, Connectivity, Culture, Capital, and Infrastructure. Talent focuses on developing skilled entrepreneurs through education and training. Density emphasizes creating concentrated hubs where entrepreneurs and resources intersect. Connectivity ensures strong relationships between ecosystem players, fostering collaboration. Culture promotes risk-taking, innovation, and inclusivity. Capital provides entrepreneurs with accessible funding options, from early-stage investments to growth financing. Infrastructure supports long-term ecosystem growth through policies, physical spaces, and digital access. Together, these six pillars create a holistic framework for fostering dynamic and resilient entrepreneurial communities.

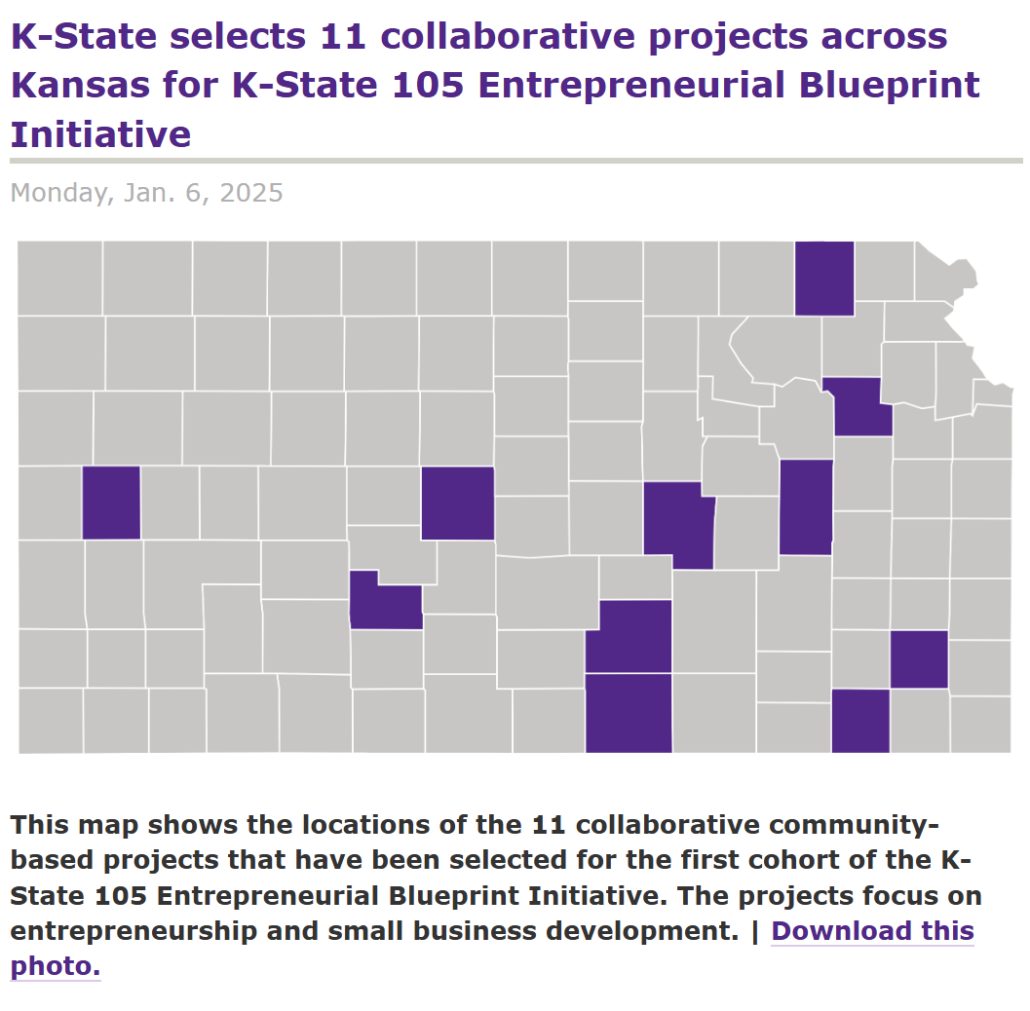

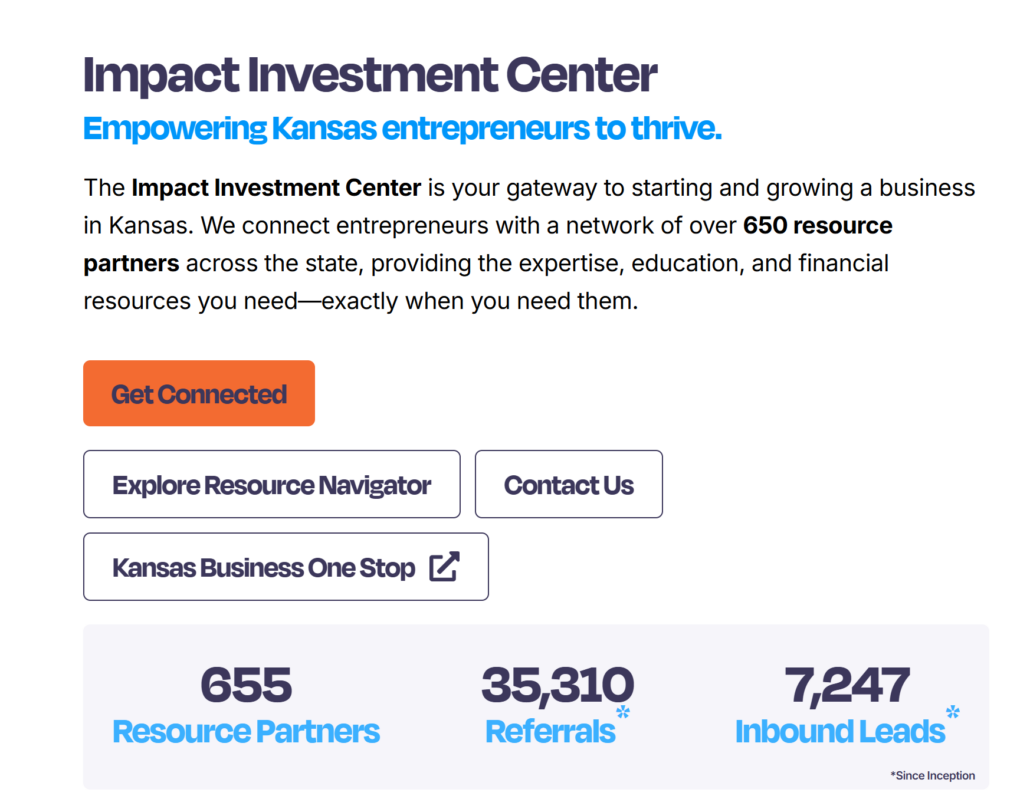

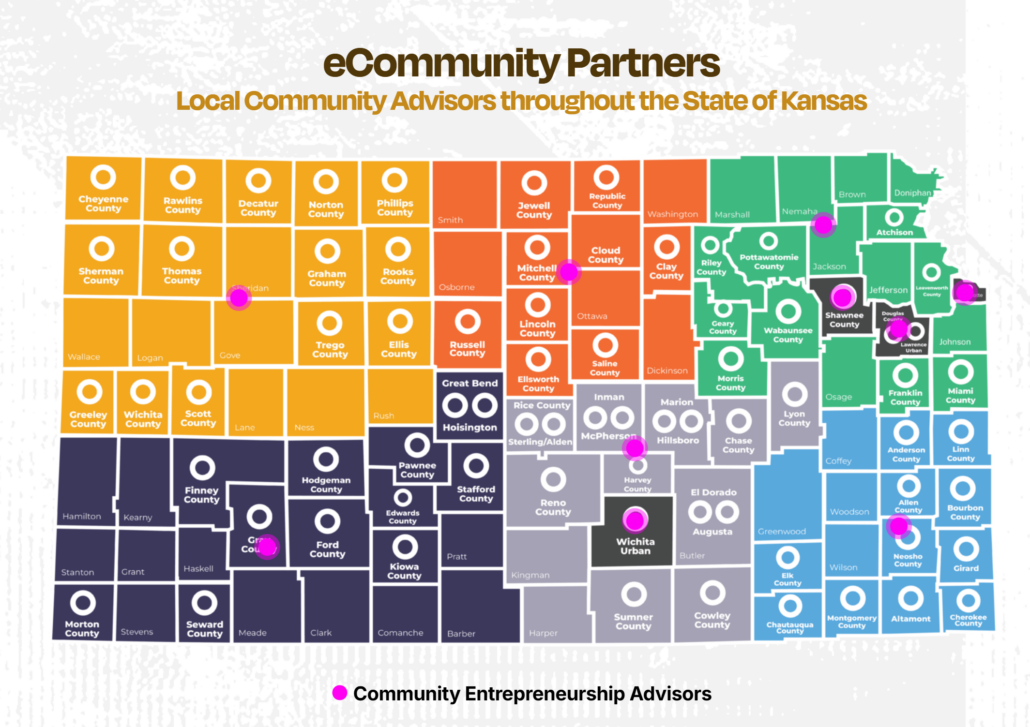

Kansas has cultivated a robust environment for small business and entrepreneurship growth. It’s impossible to tell the story of Kansas’ success without focusing on the ways in which statewide leaders created and leveraged “Strong Networks and Collaboratives” to create pathways for tackling these six pillars. See below for examples of this approach in action!

Kansas’ coordinated entrepreneurial ecosystem is producing real impact and outcomes in communities across the state. See for yourself! Check out the tabs below for descriptions of these programs, investments, and more.

Georgia’s Journey Towards Strong Entrepreneurial Ecosystems

Georgia has a tremendous opportunity to build a stronger, more connected entrepreneurial ecosystem by leveraging the lessons from Kansas. To replicate this success, Georgia-based organizations must prioritize collaboration, engage diverse stakeholders, and use impact investing as a tool for driving business growth and infrastructure development. There are three ways that Georgia’s impact investing community can act now to grow our state’s entrepreneurial ecosystem.