Fixing the Horribly Broken Healthcare System

October 2, 2020

Your business looks beyond a P&L statement for this week, this month and even this quarter, because you know that the social impact evolves and pays back over the long term. You know you and your business are doing the right thing for the right reason. Kind of like financial karma.

Imagine if that holistic wisdom and company culture you have for your finances were applied to healthcare.

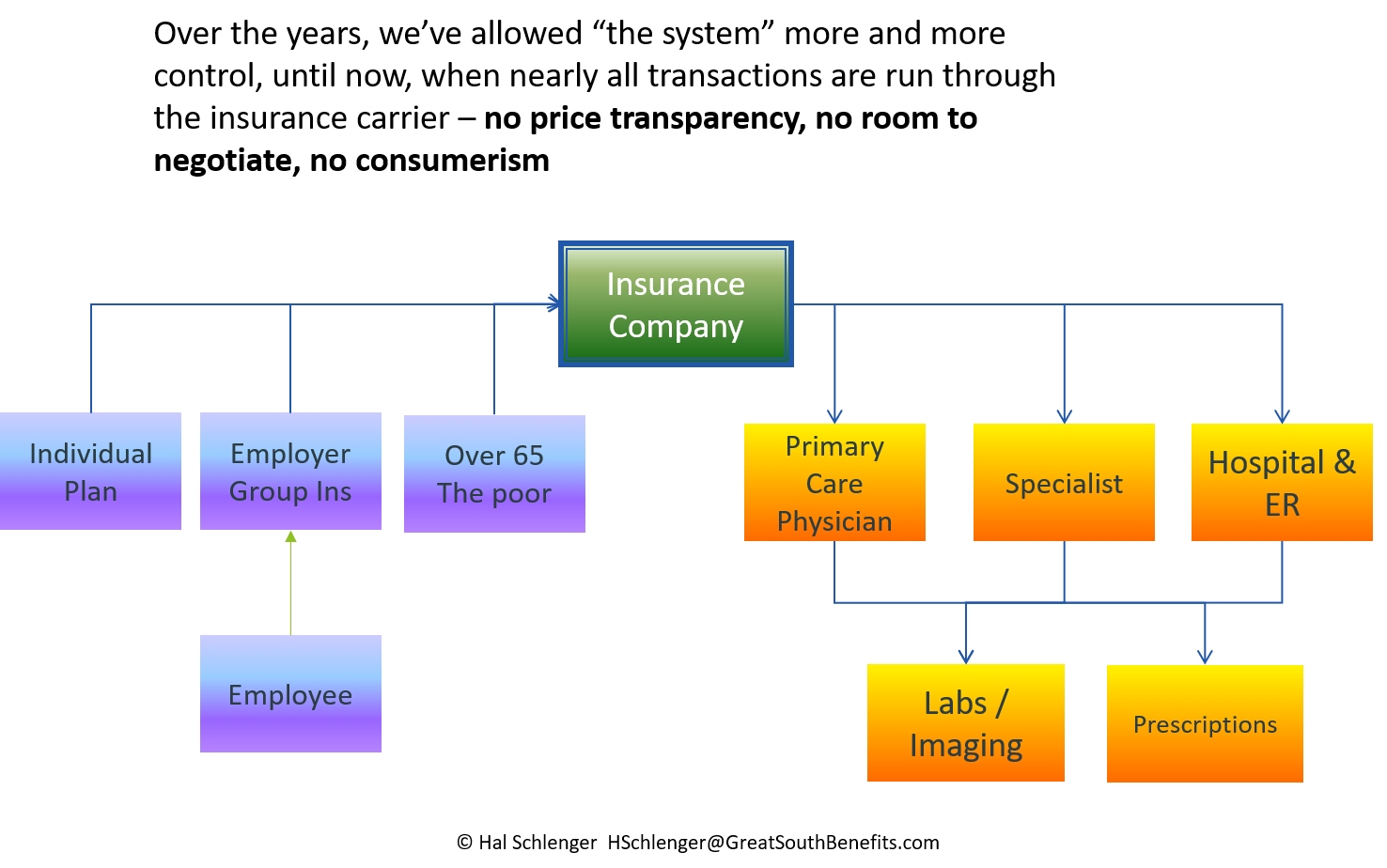

Yes, the healthcare system is terribly broken. It’s expensive. It’s complex. It’s not transparent. It’s enraging. It’s hard to know who to trust. You know financial incentives aren’t aligned when it’s cheaper to buy a medication with cash than with your insurance plan’s discount, and when it’s cheaper and faster to have a 3-minute conversation with you doctor but you’re told you must drive to and sit in the doctor’s office to have that 3-minute conversation.

You don’t have to imagine such a holistic solution. It exists, and a few brokers and agencies are on the forefront of enabling the transformation.

And isn’t the reason you don’t know about this holistic solution the same reason more people don’t know about B Corp and B Local Georgia? Too many people believe “you either make money or you can do good.” In healthcare, you either spend less money or provide better access and better care. Both of these, however, are false dichotomies.

To have your company and your employees’ best interest in mind, look for health plans with the following cost-containment strategies

- Return premiums if the employees have a healthy year

- You can use returned funds to help your company and/or return it to the employees

- Encourage price transparency, similar to nearly all other consumer transactions

- Help your employees make better decisions

- Reward behaviors that lead to price stability

- Consider the role of primary care

- It’s called “primary” for a reason. While your plan should not require a referral from a primary care physician for specialist care or imaging, 24/7 access to primary care reduces the dependence on Urgent Care and expensive Emergency Room/Emergency Department visits.

- Don’t be restricted by in- and out-of-network doctors and facilities

- Again, the idea is to let you and your employees be responsible consumers instead of accepting an opaque system of costs. You select your doctor. Your doctor may have advice. Your family and friends may have advice. There is online information. Shouldn’t you be allowed to decide who takes care of you instead of a team of profit-oriented insurance administrators creating a limited network of providers?

It can be that simple.

Yes, but while the concept of price transparency and having the doctor/patient control the care instead of the insurance carrier is simple, the execution is not.

What if people have pre-existing conditions? What’s considered affordable? Can I keep our same pediatrician? What if I have an emergency out-of-town? Prescription medications seem really, really expensive without a “Cadillac insurance plan?” BTW: Why is a “wellness exam” only once a year when my dentist does preventative care twice or thrice a year?

That’s what we do. We educate, we expose, and we guide you. Your decision making then becomes simple.

To take control:

- Define your requirements for a good solution, including:

- What you like about your current (or past) plans and what you don’t like

- Who is included (employees, dependents, 1099 contractors)

- What you can afford monthly

- What your employees can afford monthly

- Your level of acceptance for innovation and change

- Invite an initial consultation to review your requirements

- Compare to what you have

- Obtain initial proposals (the plans’ features and rates)

- Tweak the benefits to your budget

- If you make the shift, then monitor with your broker at least quarterly your actual costs and employee engagement

Intentionally different healthcare. Are you and your budget ready for better and smarter?

###

Intentionally different. Because the healthcare system is horribly broken, we help you explore options that shift the control from the insurance carrier to you (and your doctors). We educate. We guide. We incentivize. We simplify. We stabilize. We integrate. And we provide ongoing support. Your result is lower premiums, lower out-of-pocket annual spending, better access to healthcare, and happier and more productive employees.

Decided you’ve had enough and want something better? Let’s talk about our “I’ve Had Enough” plans. Contact Hal Schlenger at [email protected], 770-335-0077, www.GreatSouthBenefits.com