New Data Reveals Holes in Georgia’s CDFI Marketplace

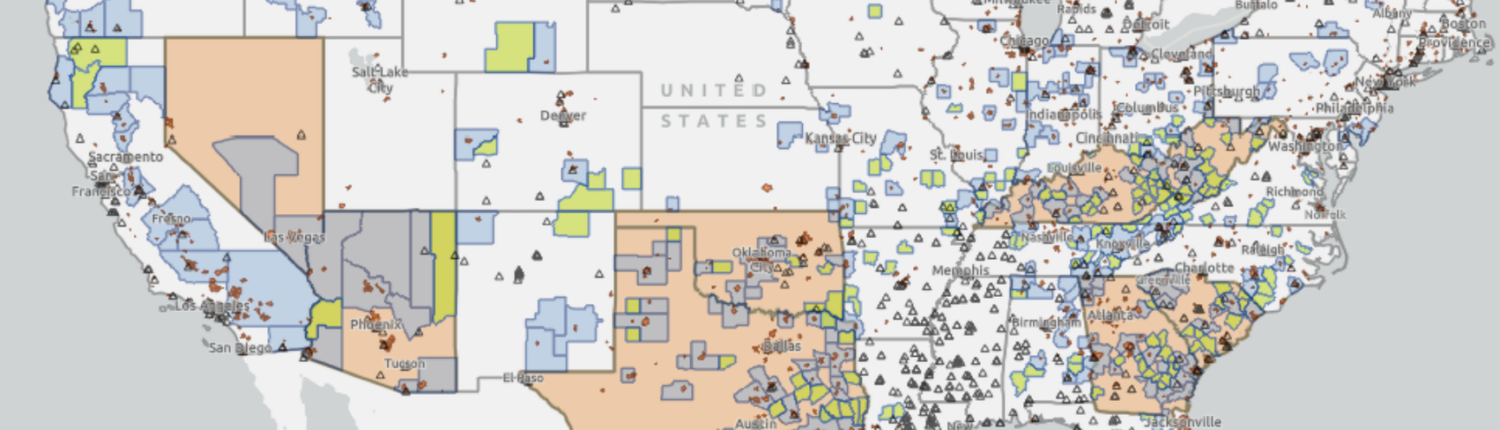

New data from CDFI Friendly America highlights a critical challenge facing Georgia: it remains one of just nine U.S. states labeled a “CDFI Desert,” reflecting a severe shortage of community development financial institution (CDFI) investment in low-to-moderate income communities across the state. Over the last decade, significant progress has been made growing both the amount of CDFI investment and the level of federal funding flowing into the state. However, large portions of Georgia—especially areas beyond Atlanta—continue to be underserved, limiting opportunities for economic growth and financial inclusion.

Despite billions of dollars in federal investment and a growing focus on economic equity, Georgia’s financial deserts remain vast—and largely unaddressed. Our latest report, Field Insights: CDFI Deserts and the State of CDFIs in Georgia, GSIC’s Executive Director – Sydney England – dives into the data. We hope this analysis helps leaders across Georgia understand where capital is and is not flowing, identifies the common barriers that prevent distributed CDFI investment, and offers actionable strategies for addressing these gaps, and outlines how funders, investors, community leaders, and others can collaborate to build a more equitable capital ecosystem across the state. Now is the time to turn awareness into action and unlock the potential of mission-driven investment across Georgia.

Highlights from the Insights Report

We hope you’ll take time to read the full report below, but here are a few key takeaways to capture your interest:

Acknowledgements

Many thanks to CDFI Friendly America for answering our data questions and for making this tremendous field-building resource available.

Read the Full Report

This report is a call to action—for funders, policymakers, anchor institutions, and CDFIs themselves—to rethink how capital flows (or fails to flow) across our state. Georgia’s future prosperity depends on more equitable access to mission-driven financing, especially in communities that are rich in resilience but lacking sufficient investment.