Take Risk and Get Paid Handsomely: One Entrepreneur’s Challenge to Start Ups and Impact Investors

March 23, 2019

By: Jeannie Tarkenton, Founder/CEO, Funding University

Being part of the impact investment “ecosystem” these days means you likely have a mash up of issues on your mind because – thankfully – the movement has matured enough to now have factions, detractors, champions, victors and losers. As a social entrepreneur highly focused on solving one problem – in our case, the problem of access to financial products needed to complete college – I have followed the arc of and commentary on impact investing. But I mostly have been playing in my corner, building a business brick by brick with my team, and learning from our early engaged customers. Over the past four years, however, I have gained a weeds-level view of impact entrepreneurialism and investing. I have a bold challenge to put forth to impact investors and to my fellow social entrepreneurs: Invest more seed capital in exchange for more equity.

Investors should acknowledge and embrace that social impact companies are uniquely difficult to get off the ground. Social enterprises work to retrain ingrained systems such as banking, food production, education, workforce training; they often work against social norms, attitudes, and human biases.

If our goal is to bring more socially focused companies to life, impact investors should account for a higher portion of angel, seed and early stage investments in the investment market. I (humbly) push you to include earlier stage investments in your portfolios AND to demand to be richly compensated for your earlier, higher risk, “rocket fuel” position. Take more equity, more warrants, more board seats, and higher interest rates in exchange for your early, patient capital.

And, now, to my fellow social entrepreneurs, I posit that we need to embrace this compact on our side. In tackling a problem that other entrepreneurs found too difficult to address, we must be prepared to:

1) Consider giving up more ownership of our companies early;

2) Be rigorous as to our concepts’ abilities to scale to a stage in which impact investment is not the only capital attracted to our business model; and,

3) Use early stage impact capital in highly focused ways that will catapult us to achieve milestones needed to attract traditional capital to our stack.

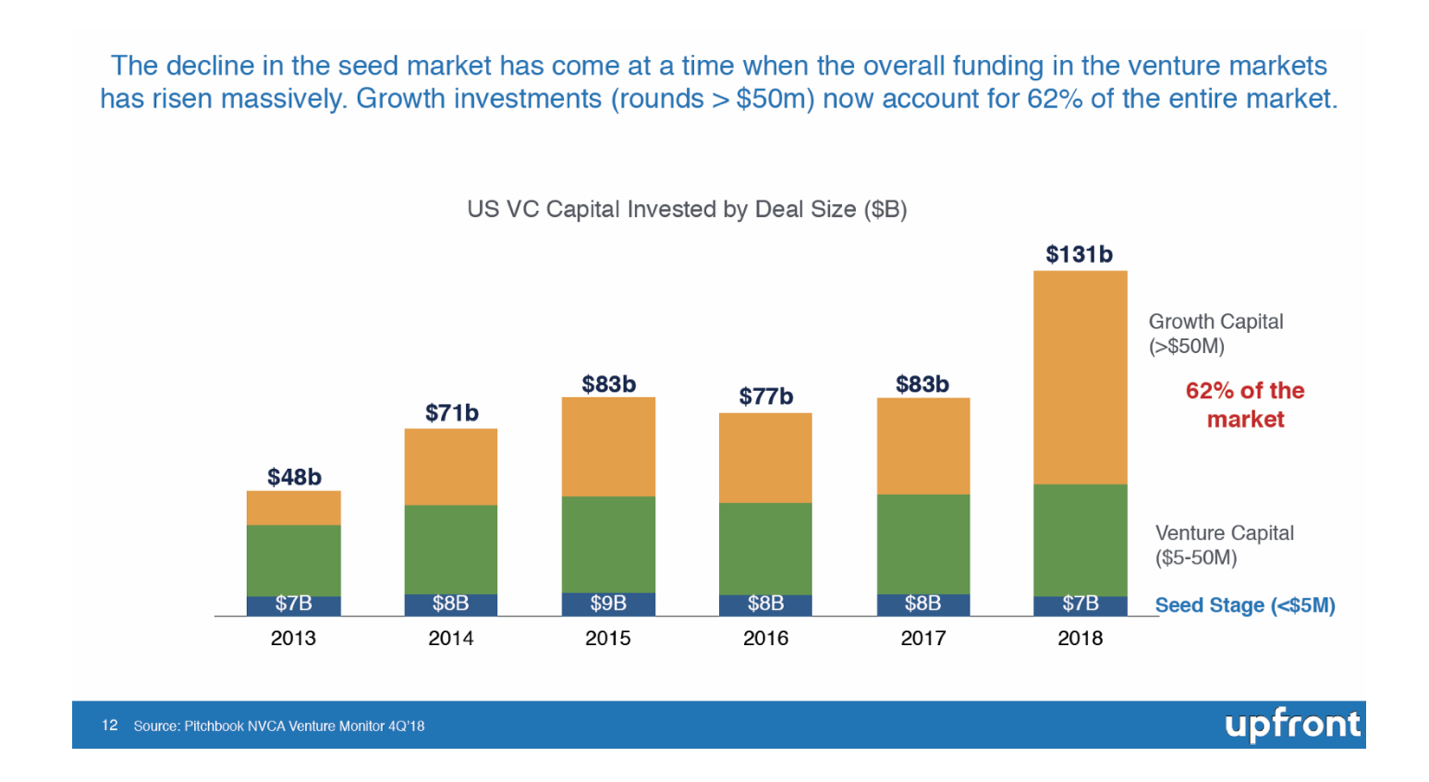

Why is this especially important now? Due to a number of factors, “Seed Stage” investments are slowing significantly, and show no signs of bouncing any time soon. (See table.)

As the Seed Stage market tightens, trends show that any investment labeled “patient” or “social impact” will naturally be trimmed from the overall pool. Seed Stage impact investment funds are already fairly rare, with A to C rounds being where most impact funds make their mark.

The upside to investors who may choose to position some of their money in Angel and Seed Stage is that early-stage capital comes with a lot of exciting, hands-on opportunities to chart the path of a company. For multi-generational family office investors this may be an ideal fit in that younger members of the family may already be asking for more involvement in investments. The ImPact wrote a detailed guide to bring these strategies to life.

The Funding U early investors and board members have given our organization valuable insights and support; and, they each have said they, in return, gained priceless insights and energy from being part of our early growth and maturation.

###

Jeannie Tarkenton is the Co-Founder and CEO of Funding U, a fintech company based in Atlanta and operating across the US that uses data analytics to provide ‘last gap’ student loans to low and moderate income students who are rejected by banks because they do not have parent co-signers. The Company’s mission is to remove the financial barrier to college completion while limiting student debt load and providing financial and credit education for customers. Funding U accepts debt investments for its loan fund and provides high single digit returns to investors. Atlanta investors include the Fuqua Family Office. For more information, please contact [email protected]

The Georgia Social Impact Collaborative (GSIC) provides resources to connect, educate and inspire stakeholders for the purpose of accelerating the development of Georgia’s impact investing ecosystem. Recently, GSIC announced the launch of the Georgia Social Impact Map (the “Map”), an interactive platform designed to connect and educate stakeholders interested in accelerating impact investing for social outcomes. Intended as a resource for communities around the state, the Map connects new forms of capital to sustaining and scaling solutions to social challenges. GSIC also provides workshops and programming for training specific groups of stakeholders on ways to leverage impact investing to achieve their impact goals, such as the workshop described below, which was attended by 30 leaders of some of GA’s top social enterprises and nonprofits.

Funding U

Funding U